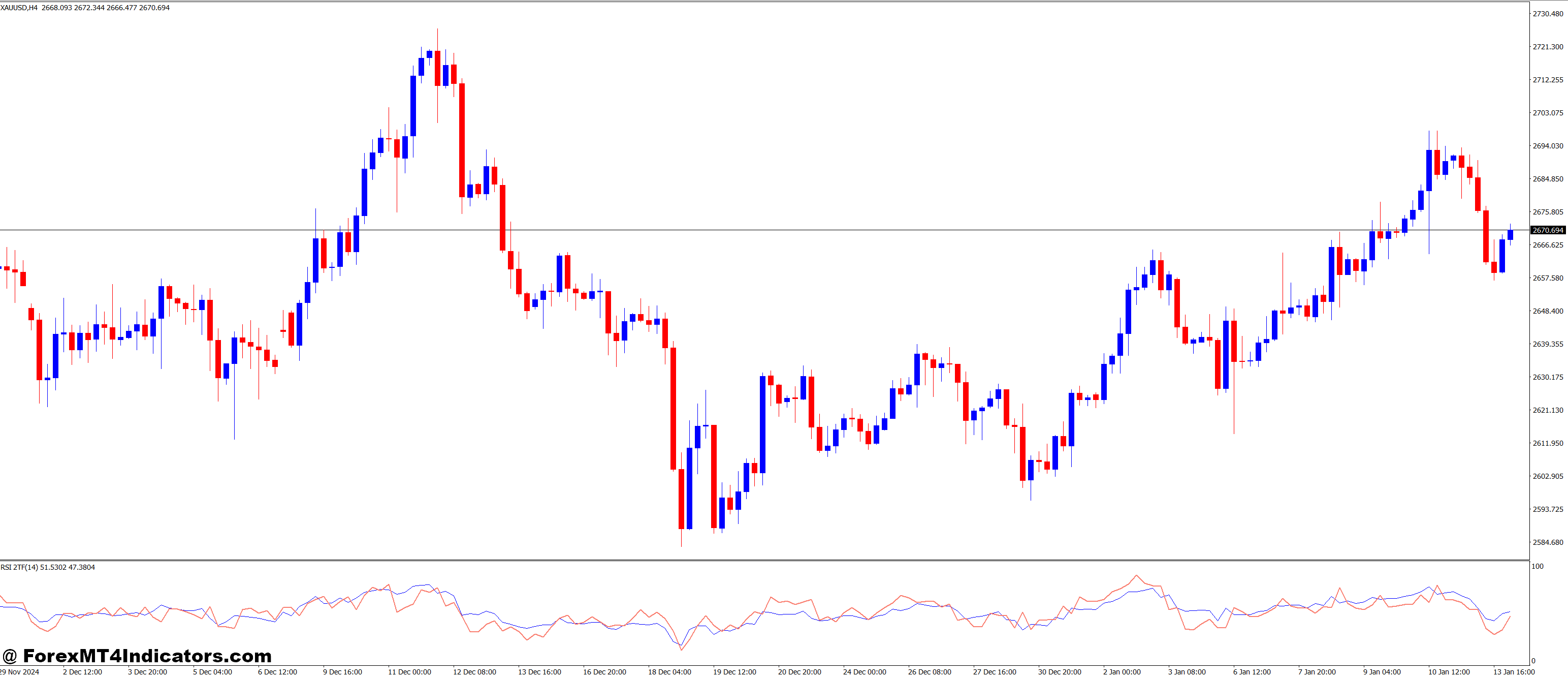

The RSI 2 TimeFrames MT4 Indicator builds on the classic RSI by applying it to two separate timeframes at once. Traditional RSI measures momentum within one timeframe, often confusing when signals conflict across periods. By showing RSI readings on both a shorter and longer timeframe, this indicator gives traders a clearer picture of market momentum and trend strength. This dual analysis helps avoid false breakouts and improves the timing of trades.

How It Enhances Trading Decisions

Using two timeframes together allows traders to confirm signals before acting. For example, if the RSI shows an oversold condition on the shorter timeframe but remains neutral or bullish on the longer timeframe, the trader gains valuable insight into whether the move is a short-term pullback or the start of a reversal. This layered information reduces guesswork and supports smarter entries and exits, ultimately increasing the probability of profitable trades.

User-Friendly Features and Practical Benefits

Designed for the MetaTrader 4 platform, this indicator integrates smoothly into existing trading setups. It offers visual alerts and clear RSI lines for both timeframes, simplifying analysis without clutter. Traders can customize the timeframes and RSI parameters to suit their strategies, making it versatile for scalping, day trading, or swing trading. By providing reliable confirmation across timeframes, it empowers traders to manage risk better and optimize trade timing.

How to Trade with RSI 2 TimeFrames MT4 Indicator

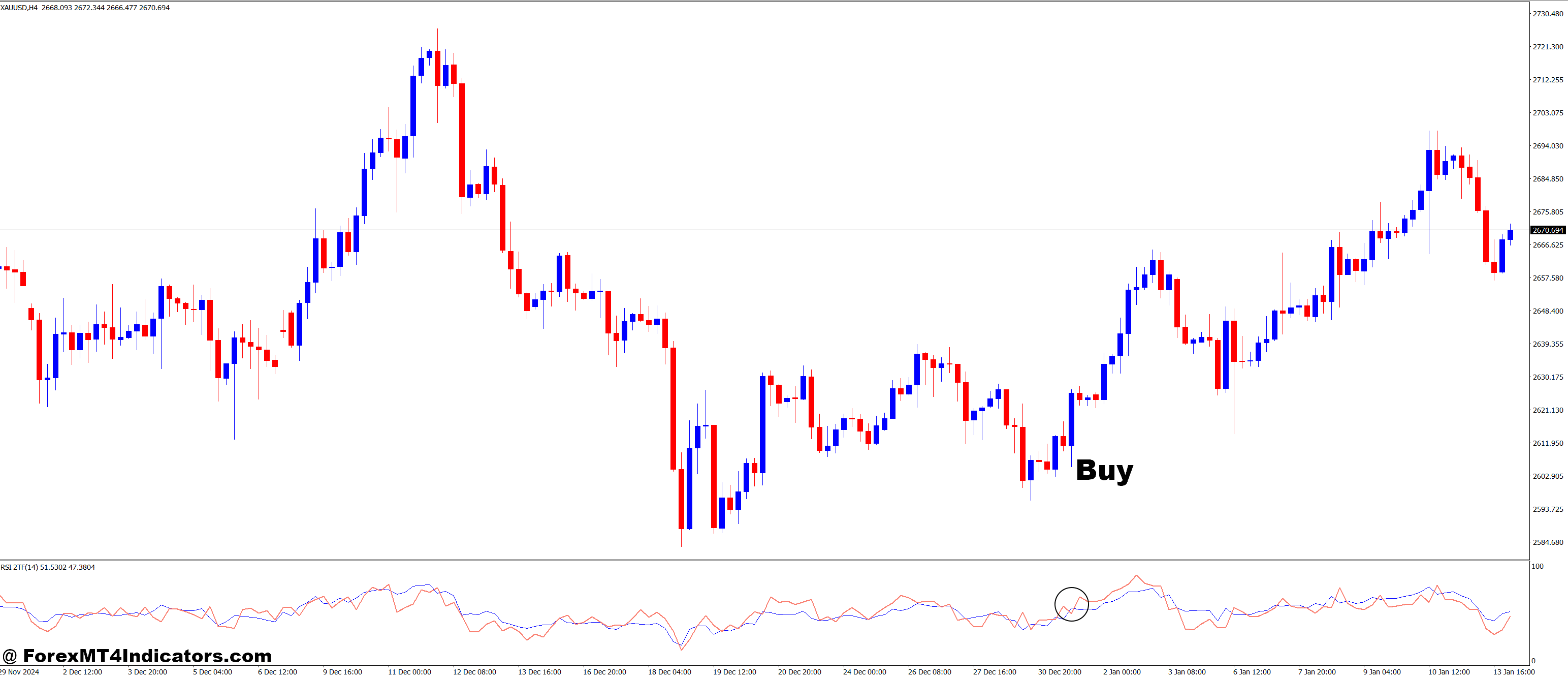

Buy Entry

- The RSI on the shorter timeframe falls below 10–15 (indicating oversold conditions).

- The RSI on the longer timeframe remains above 40 or is trending upwards (confirming overall bullish momentum).

- Look for the shorter timeframe RSI to cross back above the oversold level (e.g., rising from below 15 to above 15).

- Confirm price action supports the entry (e.g., bullish candlestick pattern or support level nearby).

- Enter the buy trade when these conditions align, placing a stop loss below recent support or swing low.

Sell Entry

- The RSI on the shorter timeframe rises above 85–90 (indicating overbought conditions).

- The RSI on the longer timeframe remains below 60 or is trending downwards (confirming overall bearish momentum).

- Watch for the shorter timeframe RSI to cross back below the overbought level (e.g., dropping from above 90 to below 90).

- Verify price action suggests weakness (e.g., bearish candlestick or resistance level).

- Enter the sell trade when confirmed, with a stop loss placed above recent resistance or swing high.

Conclusion

The RSI 2 TimeFrames MT4 Indicator is a valuable tool for traders seeking to enhance their market analysis. By combining momentum insights from two timeframes, it addresses common pitfalls of single-timeframe trading and helps identify high-probability opportunities. Whether new or experienced, traders can benefit from its clarity and precision, leading to more confident and informed trading decisions.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.